A few observations—regardless of political leanings, this is how I see China’s trajectory unfolding. Many will disagree, and that’s expected. But I work on China and Russia in the Middle East, and sharing my perspective is part of how I test and refine it. I offer these thoughts not as absolutes, but as a way to sharpen the conversation (and my mind!).

A Clash of Systems

Forget the tariffs math, the product lists, and the 90-day pauses. What’s unfolding isn’t just a trade dispute—it’s the opening phase of a broader confrontation with China.

This isn’t really about tariffs. It’s about two systems: one that can absorb disruption and adapt, and another that ties stability to survival and treats any sign of weakness as a threat to its core.

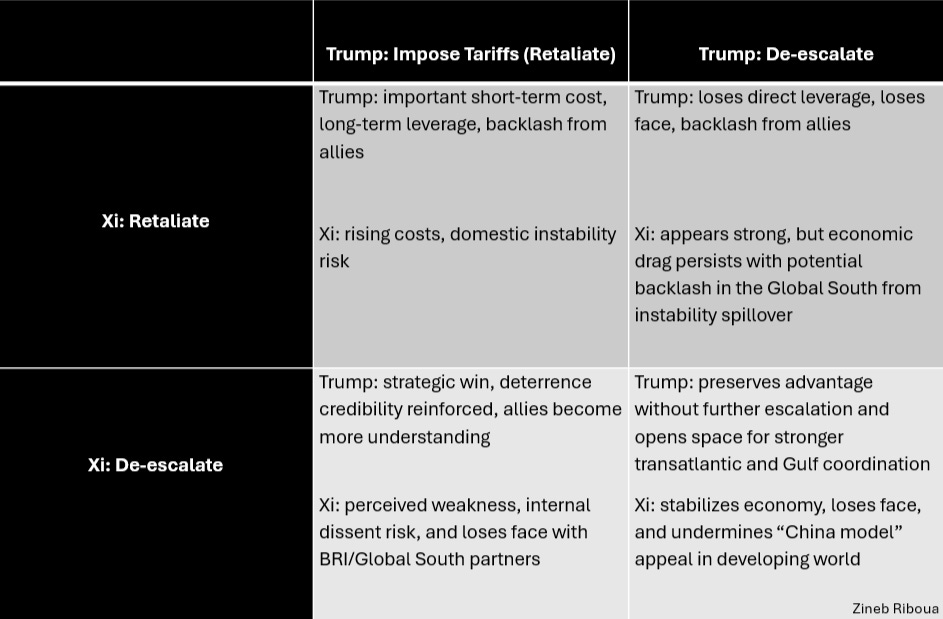

Trump operates within a chaotic but resilient framework. He can impose tariffs, weather economic backlash, and still spin it as strength. U.S. institutions tolerate friction. Markets fluctuate, voters react, but the system bends without breaking. If needed, Trump can pivot and still call Xi a loser.

Xi has no such margin. His system is rigid, centralized, and tied to a promise of uninterrupted growth. Every move must signal strength—externally and internally. Retaliating against the U.S. comes at real economic cost; backing down risks exposing fragility. In Xi’s China, appearing weak is not an option; his system was built to dominate, not to adapt.

Both can escalate or de-escalate—but only one has strategic flexibility. Trump can ride out volatility. Xi must preserve the illusion of control. That’s the asymmetry—and it matters.

More than that, at its core, Trump’s trade war is a reconfiguration. His repeated attacks on the World Trade Organization, threats to withdraw, and efforts to bypass multilateral forums all signal a deeper strategy: to reset the rules of global trade in ways that constrain China’s model. For decades, China used the WTO system to scale its export economy while shielding its domestic market. That asymmetric advantage is now being challenged at the foundation.

This matters because China’s rise was predicated on an open global system it never fully subscribed to. If the architecture itself shifts—toward bilateral leverage, industrial policy, and enforcement mechanisms China doesn’t control—Beijing faces a world it can no longer game. This is systemic recalibration—and China’s model wasn’t built to survive it.

China's Strategic Trap

Let’s look at what this pressure really means for China—because it’s exposing structural limits.

China’s rise followed a clear strategy: dominate trade, finance infrastructure, and become indispensable—without becoming vulnerable. The Belt and Road, export dominance, and supply chain control were all designed to entangle others while shielding China itself.

That approach works in stable conditions. But under sustained stress—tariffs, tech bans, capital tightening—it starts to strain. China can project power, but it struggles to absorb pressure.

The problem is systemic. China is deeply export-dependent but lacks the institutional tools that help open economies adjust. No free press. No independent courts. No space for policy shifts. Control substitutes for flexibility—and when stress builds, the system freezes instead of adapting.

For Xi, who’s tied Party legitimacy to economic performance, that rigidity is dangerous. Retaliate too hard, and the economy suffers. Pull back, and the regime risks looking weak. There’s no safe option.

Meanwhile, the Global South is watching. The question is no longer “Can China deliver growth?” but “Can it take a hit—and still deliver?”

That shift could define what comes next. If growth slows and unrest brews, Beijing faces a harsh choice: retrench and lose global ground, or push outward and risk overstretch. Neither path is sustainable.

And that’s the real gamble: China wants to be indispensable, but refuses to be adaptable. Under pressure, that contradiction grows harder to manage—and eventually, impossible to hide.

No Margin for Mistakes

These are the three core reasons why I think the CCP might not fully recover from this moment—and the four structural contradictions that make long-term resilience unlikely. My goal isn’t to predict collapse, but to simply map the limits of a model now facing its most serious strategic test:

The Legitimacy Trap

“Development is the Party’s top priority in governing and rejuvenating the country.”

—Xi Jinping, Report to the 19th Party Congress, October 2017The CCP’s claim to rule is tied not to elections or less to ideology, but to performance—specifically, growth. But with GDP growth slowing, youth unemployment, and a weakening property sector, the regime’s economic narrative is fracturing. There is no democratic buffer or ideological fallback. If performance stalls, so does legitimacy.

Bureaucratic and Institutional Rigidity

The system is engineered for control, not adaptation. The CCP governs through centralized authority and bureaucratic compliance—not competition of ideas or institutional self-correction. This rigidity creates a dangerous cycle. The greater the pressure, the narrower the decision-making becomes. Problems are concealed rather than solved. What begins as a crisis quickly becomes a deeper structural vulnerability—not in spite of the system, but because of how it is designed to function.Strategic Overextension

China’s international influence has long relied on projecting reliability—especially in the Global South. But as external pressure mounts, Beijing has proven slow to restructure debt, deliver stalled infrastructure projects, or engage multilaterally with transparency. The result: partners are hedging. Sri Lanka turned to the IMF and India after delays from Beijing. Others are quietly doing the same. What once looked like strategic entanglement now looks like strategic overreach. Trust is fraying—and with it, China’s soft power.

Here’s how China’s structural vulnerabilities unfold—and why they make long-term resilience increasingly unlikely:

The Surplus–Openness Paradox

China’s prosperity depends on exports. But tariffs, tech bans, and supply chain exits are choking off the very surpluses that fund its domestic and global ambitions. The more China needs global openness, the more fragile it becomes when that openness is withdrawn.Local Fiscal Implosion

China’s local governments are burdened by over $9 trillion in hidden debt. With land sales drying up and shadow financing collapsing, their main revenue streams are vanishing—just as social obligations rise. The result: growing political pressure and mounting fiscal unsustainability.The Energy Insecurity Gap

Despite its industrial scale, China imports over 70% of its oil and remains highly vulnerable to external shocks. U.S. sanctions on Iran matter because they limit Beijing’s access to one of its few discounted, non-Western energy sources. Every sanctioned barrel raises the cost and risk of China’s energy strategy—tightening U.S. leverage at a critical chokepoint in China’s economic model.

When Integration Backfires

China’s rise depended on integration with Western markets. As the U.S. and its allies decouple in key sectors, Beijing faces fewer reliable partners. Substitutes are costly and limited. The more others de-risk from China, the more isolated its economy becomes.

China: Built for Scale, Not Strain

The U.S. bet is straightforward: apply sustained pressure, and China won’t adapt—it will entrench. And that entrenchment carries a cost: eroded credibility, weakened partnerships, and mounting internal strain. Because power without flexibility isn’t strength—it’s vulnerability.

What Trump is doing—deliberately or by instinct—is testing the limits of the Chinese model. Through tariffs, tech bans, and strategic decoupling, he’s forcing Beijing to operate in a global system it doesn’t control, under conditions it can’t stabilize.

China’s rise depended on a frictionless world: permissive globalization, cheap capital, and open markets. It scaled influence without reform. Trump’s actions introduce friction at every node—exposing the fragility behind the façade.

The question isn’t whether China can strike back—it can. The real question is whether its system can evolve under sustained pressure. So far, the evidence suggests otherwise. And while this may not be collapse, the early signs of structural strain are already visible. The real test isn’t how big China is at scale—it’s how resilient it is when the pressure doesn’t stop.

Lot of good analysis and facts about China’s position both as an export economy and a rigid authoritarian state here! Enjoyed reading.

I see two challenges here though: 1) I think the US threatening to impose these levies out of clear blue sky is creating a rally-around-the-flag moment in China just as it is in most other countries (such as in Canada, or as seen in increasing solidarity with multilateral bodies like the EU). An external enemy has presented itself; and 2) I think it is very unclear that the US threat to impose such high tariffs on China is seen as credible by the Chinese. The Chinese know that the US acts on a short timescale and that politicians must respond to constituent outrage, which positions the US more weakly than China whose citizens have to just take it. China needs us as a customer, but I think they also know the US consumer won’t tolerate these types of price increases, especially after seeing the uproar over 9% inflation in June 2022.

But curious what your thoughts are relative to those two challenges. I agree that China presents the main challenge to the West and that they behave unfairly in trade (primarily by subsidizing their own companies).

Spot on Zineb. Great analysis and serious synthesis.